Forging Business Connections between America and the Emerald Isle since 1963

For over 50 years, The Ireland-U.S. Council has bridged the gap between the United States and Ireland by promoting business connections and fostering a strong community among our many members.

Welcome to The Ireland-U.S. Council

Our mission is to build business links between America and Ireland. We aim to create impactful relationships through the organization's many programs and activities in both the United States and in the Emerald Isle. We value your interest in the mission of the Council and always welcome new members. Please contact us and we will be happy to tell you more.

The Ireland-U.S. Council’s Saint Patrick’s Luncheon

The Ireland-U.S. Council held its Annual Saint Patrick’s Luncheon at The Metropolitan Club in New York City on Friday, March 15, 2024. This short video captures all the highlights of this ever popular event on our calendar.

The Ireland-U.S. Council presents its

2023 Award for Outstanding Achievement

The Ireland-U.S. Council’s 60th Annual Dinner was held at The Metropolitan Club in New York City on Thursday, November 9, 2023. The Council’s Annual Award for Outstanding Achievement was presented to David McCourt, Chairman and Founder of Granahan McCourt Capital and also Chairman & CEO of National Broadband Ireland. The Council’s Cúchulainn Award was presented to Northern Ireland entrepreneur Dr. Terry Cross OBE. Pictured at the Diamond Anniversary dinner (from left): David McCourt; Tom Higgins, President of the Ireland-U.S. Council and Dr. Cross.

The Ireland-U.S. Council Midsummer Gala Dinner was held

at Saint Patrick's Hall in Dublin Castle on June 30, 2023

The Ireland-U.S. Council

Ireland-U.S. Council presents its 2022 Award for Outstanding Achievement

The Ireland-U.S. Council presented its Award for Outstanding Achievement in 2022 to Dermot Desmond, Chairman & CEO of Dublin-based International Investment & Underwriting to mark his notable success in business. The Award also heralded his important achievements in building bonds between America and Ireland. The Award was a centerpiece of the Council’s 59th Annual Dinner which was held at the Metropolitan Club in New York City on Thursday, November 10, 2022.

Seen at the presentation were Tom Higgins, Council President, Dermot Desmond and Denis O'Brien, Chairman of Digicel who made the podium introduction for the honoree.

Spring Corporate Lunch

Dublin

Thursday, April 25, 2024

InterContinental Hotel

Ballsbridge, Dublin 4

12 noon Cocktails

12:45pm Lunch

Individual Ticket: €150

Shamrock Table: €2,500

(includes premium table for 10 guests, full page full-color ad in Menu program)

Harp Table: €4,000

(includes premium table for 10 guests, full page full-color ad in Menu program, company signage, podium recognition and more )

2024 Ireland-U.S. Council Award

for Excellence in International Business

Dr. John Teeling

Download Spring Corporate Lunch Invite (PDF)

Book and Pay Online:

Midsummer Gala Dinner

Friday, June 28, 2024

Dublin Castle

Dublin, Ireland

Council Golf Day in Ireland

Friday, September 6, 2024

Dún Laoghaire Golf Club,

Enniskerry, Co. Wicklow, Ireland

61st Annual Dinner of the Council

Thursday, November 14, 2024

The Metropolitan Club, New York City

Edmund Burke Lecture

Thursday, November 21, 2024

Royal Irish Academy of Music, Whyte Recital Hall

Followed by refreshments @ Kennedy’s on Westland Row / Lincoln Place, Dublin, Ireland

A message from our President

Tom Higgins

Council President

It was back in 1962 that, in preparation for the visit of President John F. Kennedy to Ireland the following year, two organizations were created as a measure to build institutional form around a structure to improve the relations between America and Ireland.

One was dedicated to cultural relations - the American Irish Foundation, which has since merged into the American Ireland Fund. Your Council was the other and was aimed at building business bonds between America and Ireland.

We cherish the shared commitments that connect us to our Council mission. During the past year, the Council has enjoyed outstanding support from members and from many benefactors, patrons and sponsors. On behalf of the Council's Board and the entire membership of the organization throughout the United States and in all parts of Ireland, we offer thanks for the support we continue to receive.

Tom Higgins

Ireland-U.S. Council President

Recent Council News

Council Programs

Student Work Experience Scholarships

The Ireland - U.S. Council Annual Student Work Experience Scholarship program is operated by the Council in which undergraduates from Irish Universities are assigned temporarily to work in American corporations. The Council also operates a program for post-graduate American students who work as management interns for companies in Ireland.

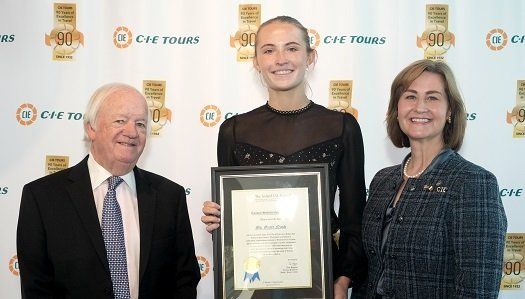

Award For Outstanding Portraiture

The Ireland-U.S. Council Award for Outstanding Portraiture is an important part of the Ireland-U.S. Council’s program to support the Arts and Arts Education in Ireland. The esteemed award has been an important career marker for many of today’s successful portrait painters in Ireland and is presented in Ireland to an artist whose work is judged to be of outstanding merit.

Award for Outstanding Achievement

The Ireland - U.S. Council each year presents its Award for Outstanding Achievement to an individual who has made a significant contribution to enhancing the economic relationships between the United States and Ireland. The annual Award marks notable and important achievements in building the business bonds and commercial connections between America and the Emerald Isle. The Award is the centerpiece of the Council’s Annual Dinner held at the Metropolitan Club in November in New York City.

Creating connections since 1963

The Ireland-U.S. Council is the premier platform in the exciting and dynamic trans-Atlantic business universe connecting America and Ireland . This is one of the world’s most rapidly-expanding bilateral relationships embracing billions of dollars in trade, investment and tourism. Embrace connection today for expansion in the future—complete your member application today.

Sign up to receive updates on the Council's latest news & upcoming events

Contact Us

We will get back to you as soon as possible

Please try again later

The Ireland-U.S. Council | All Rights Reserved | Privacy Policy